Life Insurance

Life has helped countless families to manage after the unexpected loss of a loved one. Safeguard your family, business, and your legacy financial future by purchasing life insurance with us

WHAT IS LIFE INSURANCE POLICY ?

Purchasing life insurance allows you to provide a safety net for your loved ones in case you pass away. A life insurance policy is a contract stating that, as long as your premium is paid and the policy is active when you die, your beneficiaries can receive a death benefit payout to be used however they like — for final expenses, paying off outstanding debt, and even everyday costs.

At Imani Legacy Leadership Development, safeguarding your loved ones’ future is paramount. Our life insurance services are meticulously designed to offer comprehensive coverage tailored precisely to your family’s unique needs. We prioritize securing your family’s financial stability and ensuring peace of mind during life’s uncertainties.

Who needs life insurance

Life insurance policies generally fall into three categories: term, permanent, and final expense. Once you understand the difference, you can easily determine which is right for your beneficiaries’ needs and your budget.

Families

Protect your loved ones with customizable life insurance solutions, offering security and reassurance.

Business owners

Entrepreneurs and business owners benefit from life insurance, offering financial stability and safeguarding business continuity.

Retirees

Even in retirement, life insurance plays a crucial role, helping retirees secure their legacy and provide for future generations.

Types of life insurance products

Life insurance policies generally fall into three categories: term, permanent, and final expense. Once you understand the difference, you can easily determine which is right for your beneficiaries’ needs and your budget.

Term Life

Term life insurance provides coverage for a specified period or term, typically ranging from 10 to 30 years. It offers a death benefit to beneficiaries if the policyholder passes away during the specified term. Once the term ends, the coverage ceases unless renewed, often at higher premiums due to age-related factors. Term life insurance policies do not accumulate cash value over time.

- Coverage Duration: Term life insurance offers coverage for a specific duration, typically ranging from 10 to 30 years.

- Premiums: Known for its affordability, term life insurance policies generally have lower premiums compared to whole life insurance for the same coverage amount.

- No Cash Value: Unlike whole life insurance, term policies do not accumulate cash value over time.

- Flexibility: Suited for specific financial needs during a certain phase of life, such as paying off a mortgage or covering children's education expenses.

Whole life

Whole life insurance is a form of permanent life insurance that offers coverage for the entire lifetime of the insured individual, provided premiums are paid. It not only provides a death benefit but also includes a cash value component that grows over time. This cash value accumulation serves as a savings element within the policy, allowing for potential loans or withdrawals against it.

Lifelong Coverage: Whole life insurance provides coverage throughout the policyholder's lifetime, as long as premiums are paid.

Cash Value Accumulation: One of its defining features is the accumulation of cash value over time, serving as a savings component within the policy.

Premiums: Generally higher than term life insurance but remain fixed throughout the policy's duration.

Guaranteed Benefits: Offers a guaranteed death benefit to beneficiaries, along with potential dividends depending on the policy and company's performance.

Term life insurance with a term of 10, 15, 20, or 30 years makes sense if:

- You support a partner, spouse, or children

- You're paying off debt, like a mortgage

- Your loved ones depend on your income

Example: You're married, in your 20s, and a new homeowner with a 30-year $250,000 mortgage. You get a 30-year term life insurance policy with $250,000 of coverage and name your spouse as the beneficiary. In case you pass away in the next 30 years, they can use the death benefit to pay off the mortgage and cover other costs.

How much life insurance do you need?

Determining the ideal coverage involves several vital considerations.

- Age,

- Current health,

- Household income, and

- The number of dependents play a crucial role in determining the required coverage.

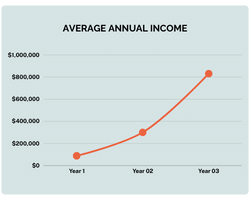

Additionally, pivotal life events like marriage, parenthood, or income changes profoundly impact your life insurance needs. As a general rule, it’s advisable to aim for coverage approximately 10 times your annual household income. For instance, if your current household income is $60,000, a recommended coverage amount would be $600,000, ensuring a safety net for your family’s financial security.

Keep in mind that permanent life policies generally cost more than term life policies. And the longer a term policy lasts, the more you’ll pay. Learn more about how much life insurance costs and compare term life insurance rates through ProgressiveLife by eFinancial to find a policy that fits your needs and budget.

Why Choose Imani legacy ?

Many people view insurance with skepticism but the truth is that insurance can play a valuable role in achieving a wide range of objectives.

Our partners and specialists can assist you in reaching all of your personal and business goals from protecting your family and business to tax-sheltering investments, delivering supplementary retirement income, planning your business succession and offsetting estate taxes. With the right strategies, you can keep treasured assets intact for you and for your loved ones.