Perhaps you’ve found yourself wondering, “Is life insurance really necessary?” or “What if I can’t afford it?” These thoughts are common and understandable, especially when balancing the responsibilities of everyday life with the weight of financial planning. As members of a community that values family, connection, and legacy, it’s vital to understand how life insurance can serve not only as a protective measure but also as a valuable financial tool.

Life insurance isn’t just about preparing for the worst; it’s about securing peace of mind. It’s about knowing that if the unexpected happens, your family will be taken care of. It’s about building a legacy that transcends borders, ensuring that your hard work and sacrifices benefit your loved ones now and in the future.

In this guide, we’ll address some of the most common questions and concerns that you may have about life insurance. We want to empower you with knowledge so you can make informed decisions that align with your unique circumstances. After all, understanding life insurance is the first step towards harnessing its benefits for you and your family. Let’s dive in together!

1. Do I Really Need Life Insurance If I’m Young and Healthy?

The Question:

“I’m young and healthy, do I really need life insurance right now? Shouldn’t I wait until I have more responsibilities or health issues?”

The Explanation:

Many people, especially those in their 20s or 30s, believe that life insurance is only necessary when they get older or start having health issues. But this is a common misconception. In reality, getting life insurance while you’re young and healthy can be the smartest financial decision you’ll make.

Why? Because life insurance premiums are based on age and health. By securing a policy at a younger age, you lock in lower rates that will stay with you throughout the life of the policy. If you wait until later, premiums could be significantly higher due to age or potential health problems that arise over time.

For example, if you’re in your late 20s and get a Term Life Insurance policy, your premium may be as low as $15 a month. However, if you wait until your 40s, that premium could triple. Moreover, unforeseen accidents or sudden illness can leave your family with financial burdens. Life insurance ensures your loved ones are financially protected.

2. How Much Life Insurance Do I Really Need?

The Question:

“How do I figure out how much life insurance I actually need? I don’t want to be over-insured or under-insured.”

The Explanation:

The amount of life insurance you need is highly personal and depends on factors like your income, your debts, and your financial goals. A good rule of thumb is to have life insurance that covers 10 to 15 times your annual income. However, you should also factor in any debts (like mortgages, student loans, or credit card balances) and future expenses, such as college tuition for children or retirement savings for your spouse.

For example, let’s say you earn $60,000 a year and have a mortgage of $200,000. You also have two children who will need money for college. A policy of $600,000-$900,000 might be a good start to cover both current and future expenses.

For those in the African diaspora, this question takes on an additional layer. Many are financially supporting not only their immediate family but also extended family members back in their home countries. In this case, you may need to consider a higher amount of life insurance to ensure that your family, both locally and abroad, is adequately supported.

3. What’s the Difference Between Term Life Insurance and Whole Life Insurance?

The Question:

“I’m confused about the different types of life insurance. What’s the difference between Term Life and Whole Life Insurance?”

The Explanation:

This is one of the most common questions people have when considering life insurance. The main difference between Term Life and Whole Life Insurance is the length of coverage and whether the policy builds cash value.

• Term Life Insurance: This type of policy provides coverage for a specific period (10, 20, or 30 years). If you pass away during the term, your beneficiaries will receive the death benefit. Term Life Insurance is often more affordable but does not build any cash value.

• Whole Life Insurance: This policy provides lifelong coverage and also has a cash value component, which grows over time. You can borrow against this cash value or even use it as part of your retirement planning. Whole Life Insurance is generally more expensive than Term Life, but it offers more flexibility and benefits.

For example, if you’re in your 30s with a young family and need affordable coverage for the next 20-30 years, Term Life Insurance may be a better fit. However, if you’re looking for a long-term financial tool that includes savings, Whole Life might be worth the investment.

4. What Happens If I Can’t Afford My Life Insurance Premiums in the Future?

The Question:

“What happens if my financial situation changes and I can’t keep up with the premium payments?”

The Explanation:

Financial circumstances can change, and this is a valid concern. Fortunately, most life insurance policies have flexible options if you ever face financial difficulty.

• Term Life Insurance: If you can no longer afford your premiums, you can often lower the amount of coverage to reduce the monthly payment. While this means your death benefit will decrease, it allows you to maintain some level of coverage without fully canceling the policy.

• Whole Life Insurance: Since Whole Life policies accumulate cash value, you may be able to use that cash to pay your premiums temporarily. Additionally, some policies come with a premium waiver in case of disability or critical illness, meaning the insurance company will cover the premiums for you during tough times.

It’s always a good idea to discuss these options with your insurance provider before canceling any policy. For those in the African diaspora, particularly individuals who send remittances to family members, life insurance can help ensure that your financial responsibilities are met, even when life takes an unexpected turn.

5. Can Life Insurance Be Used While I’m Still Alive?

The Question:

“I thought life insurance only benefits my family after I die. Is there any benefit to me while I’m still alive?”

The Explanation:

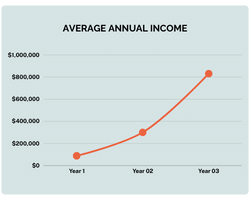

Yes, certain life insurance policies can provide financial benefits while you’re still alive. With Whole Life Insurance or Indexed Universal Life (IUL), you build cash value over time. You can borrow against this cash value for various needs, such as paying for college, starting a business, or even buying a home. Some policies also allow you to withdraw money directly from the policy, though this may reduce the death benefit.

For example, let’s say you have a Whole Life policy that has built up $50,000 in cash value. You could borrow from that amount to help pay for your child’s college tuition or cover emergency expenses. This makes life insurance not just a safety net for your loved ones after your passing, but also a flexible financial tool during your lifetime.

Which Life Insurance Is Right for You?

Understanding life insurance doesn’t have to be complicated. Whether you’re a young professional just starting out, a parent looking to protect your family, or someone supporting extended relatives, life insurance can provide peace of mind and financial stability for both you and your loved ones.

The key is finding the right policy that fits your unique needs. If you’re unsure which type of life insurance is best for you—whether it’s Term Life, Whole Life, or something else—consult with a licensed financial professional to get personalized advice.

Contact us today for a free consultation and explore your life insurance options tailored to your needs.