In today’s fast-paced world, planning for life’s certainties, like your children’s education, retirement, or unforeseen loss of income, is a priority. But what often goes overlooked is how life insurance can be a pivotal tool in this preparation. Unfortunately, there are a number of myths surrounding life insurance that hold people back from making informed decisions. Below, we break down 10 of the most common misconceptions about life insurance and reveal the truth behind them, helping you make better financial decisions for you and your loved ones.

Myth 1: Life Insurance Only Matters After I’m Gone

Fact: Life insurance isn’t just about death benefits. It’s a financial safeguard that protects against various life risks, including disability, critical illness, and longevity. The idea of “living too long” is just as crucial as untimely death. What happens if you live until 90 but retire at 60? Life insurance can help cover retirement expenses and medical costs, ensuring your financial independence throughout your lifetime.

Myth 2: My Employer’s Insurance Is Enough

Fact: Employer-provided insurance is usually limited and ends when you leave the company. While it might be sufficient when you’re young and single, it likely won’t cover your future responsibilities—whether that’s your children’s education, medical emergencies, or retirement. Relying solely on employer insurance can leave you vulnerable. Supplementing it with a personal policy tailored to your needs ensures financial security for you and your loved ones.

Myth 3: I’m Young, Single, and Healthy—Why Would I Need Insurance?

Fact: Life insurance is most beneficial when bought early. The younger and healthier you are, the lower your premiums. Plus, insurance isn’t something you buy when you need it—you prepare for future uncertainties today. Even if you don’t have dependents, securing a policy early protects against unforeseen health issues or financial responsibilities that may arise down the road.

Myth 4: Life Insurance Is Too Expensive

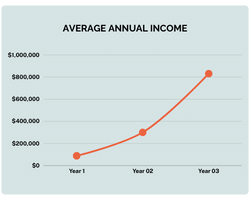

Fact: Life insurance is far more affordable than people think. Premiums vary based on age, health, and the type of policy. Younger individuals can secure significant coverage at a low cost, and term insurance offers large benefits for minimal premiums. Start small, and you can always expand your coverage as your income and responsibilities grow.

Myth 5: Term Insurance Is the Only Option

Fact: Term insurance is just one type of life insurance. Beyond term plans, there are savings-based, investment-linked, and pension-based products designed to meet a variety of financial needs. Whether you’re looking for risk management, wealth accumulation, or retirement planning, life insurance offers a wide range of solutions. Be sure to evaluate your personal financial goals before deciding which type of policy best suits you.

Myth 6: I’m Too Old or Have a Pre-existing Condition—It’s Too Late for Insurance

Fact: While age and health can affect premium costs, life insurance policies are available for all age groups and medical conditions. In fact, annuity products offer highly attractive benefits for seniors. For individuals with pre-existing conditions, insurers may adjust premiums to reflect the higher risk, but options are still available. The key is working with a knowledgeable advisor to find the right plan for your situation.

Myth 7: I Can Get Better Returns Elsewhere

Fact: Comparing life insurance to other investments without understanding its full value is like comparing apples to oranges. Life insurance provides a unique combination of features: mortality, longevity, and morbidity protection, alongside tax benefits and guaranteed returns. In the long term, life insurance can offer competitive, risk-adjusted returns, while also ensuring your family’s financial future is secure.

Myth 8: ULIPs Are Expensive and Not Worth It

Fact: Today’s Unit Linked Insurance Plans (ULIPs) are designed with lower costs and greater flexibility. Some ULIPs even refund the charges deducted during the policy term upon maturity. ULIPs allow you to switch between equity and debt funds as per market conditions, giving you the advantage of investing in multiple asset classes under a single policy. Plus, ULIPs allow for tax-free withdrawals after a certain period, offering both investment growth and liquidity.

Myth 9: Only the Policyholder Can Be Insured

Fact: Policies can cover not just the person buying the insurance, but also their spouse, children, or even both spouses under a single policy. Parents can also purchase child-specific plans to safeguard their children’s future. In fact, once children turn 18, they can take over ownership of these policies, ensuring they’re protected long into adulthood.

Myth 10: Insurance Companies Make It Difficult to Claim Benefits

Fact: The core purpose of life insurance is to pay claims, and insurers are continually streamlining their processes to ensure claims are handled efficiently. Insurance policies are contracts based on utmost good faith—claims will be honored as long as the provided information is accurate and premiums are kept up-to-date. Modern digitized processes have further simplified claim settlements, making them quicker and more transparent.

In Conclusion:

Life insurance is one of the most misunderstood financial products out there, but it’s also one of the most important. By debunking these myths, we hope to provide clarity and empower you to make informed decisions that can protect you and your family for years to come. Don’t let misinformation keep you from securing your financial future.

Every family has unique financial needs, and life insurance can be customized to meet yours. Consult with an experienced advisor, compare policies, and make the best decision for your long-term goals. In the end, life insurance isn’t just a safety net—it’s a strategic financial tool designed to give you peace of mind.

Tags:

#LifeInsuranceMyths, #FinancialPlanning, #RiskManagement, #RetirementPlanning, #InsuranceTruths, #LifeInsuranceOptions, #FinancialSecurity, #WealthProtection, #LifeInsuranceBenefits, #InsuranceInUSA, #InsuranceInCanada